Digital Transformation in Banking is no longer seen as a choice as retail banks and financial firms struggle to find an omnichannel identity in order to remain relevant. The way people buy things has drastically changed. Purchases happen across many channels, beyond walls and locations. Today’s commerce is becoming more and more platform agnostic and more personalized than ever. People have higher expectations for how they interact and engage in their digital out of home experiences. They expect the same convenience they get with their smart appliances or mobile apps. They seek out the experiences that pay off in the same way their current digital lifestyle does.

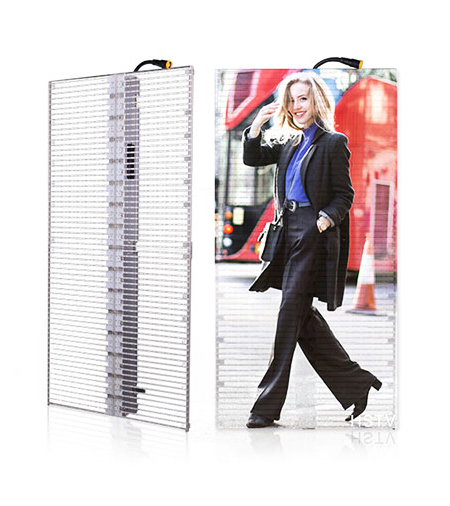

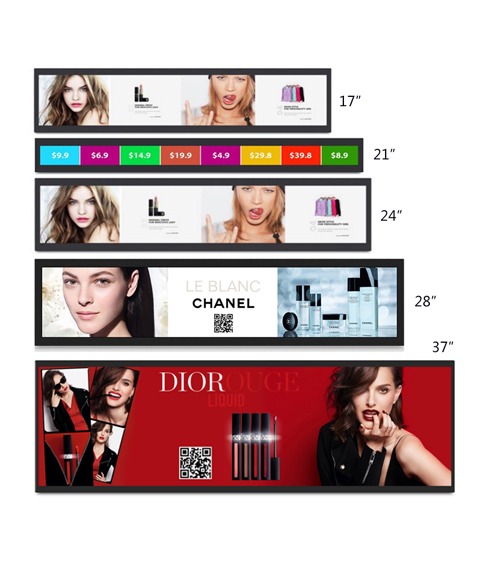

Today’s brands are connecting with their customers through digital experiences that inform, assist, and entertain. Technologies such as touchscreens, digital signage, AR and VR, are bringing products to life so that they jump off the shelf and leave an emotional attachment. The Educating and Advertising of products has never been easier or had such an impact as today.

Usually, the communication of such institutions is made through informative brochures or posters, which banks, financial institutions and insurance companies still use today, and will probably continue to use in the future. However, in the era of multi-touch tables and kiosks: these interactive tools provide a greater motivation for customers to “purchase” products.

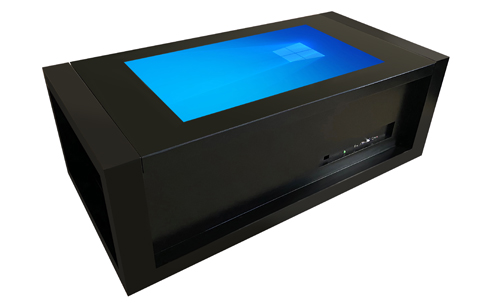

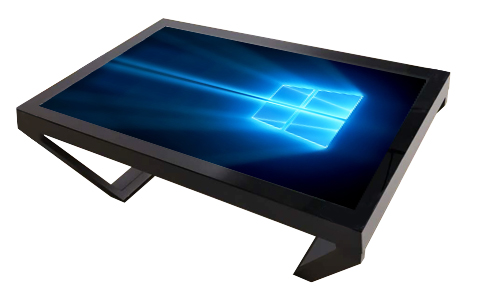

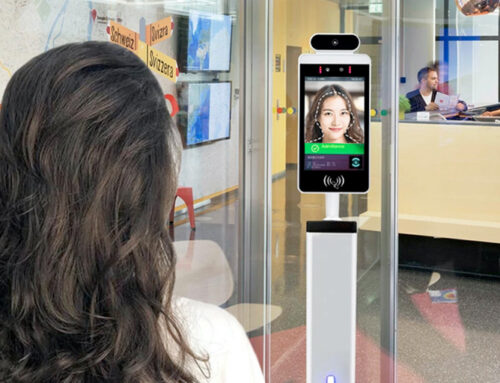

Touch tables allow for easier content sharing between the banker and customer. Multimedia files can be opened simultaneously, documents can be enlarged and moved across the screen for better reading. Security is assured through digital bar code scanning or fingerprint recognition technology.

Banks all around the world are augmenting their use of touch tables, kiosks and digital signage for in-branch branding, customer promotions, reducing perceived waiting times, and uplifting ambiance. In an era of digital disruption, banks must implement digital innovation to effectively cater to increasingly tech-savvy bank customers who expect the best products, and customer service from their banks. Customers walking into a local branch expect their bank to be at least as technologically sophisticated as they are.

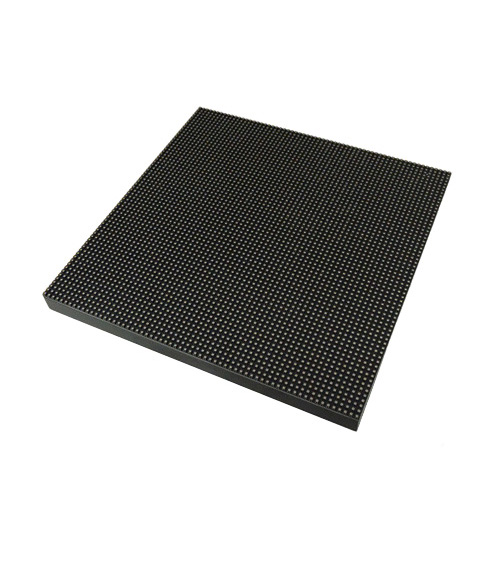

Interactive Design Café has helped banks and financial firms navigate the digital transformation landscape since 2012 with customer experience technologies like multitouch tables, interactive kiosks, digital signage, projection and holographic technologies. iDesign’s products and solutions are custom designed to meet your brand objectives and goals. We will work with you from the initial idea, through to designing and developing the experience and user journey, creating the content, choosing the right hardware and installing the final experience. Every experience is unique and no matter the size of project we will approach it with the same professionalism. We are always happy to talk through your ideas so please feel to get in touch and have a look at some of our client project examples below. Contact us for a free consultation.